How to fill out a divorce petition and summons

In the forms, you’ll tell the court when you married and when you separated and how you want your property divided, whether spousal support and other issues. You’ll also use these forms to officially tell your spouse you’ve started a divorce case.

Get familiar with a few key terms

The way you fill out these form will impact the outcome of your case, so it’ important to do it correctly. The forms include some terms that may be unfamiliar to you – especially terms for how the court treats property in a divorce.

It helps if you understand the terms the court uses (for example community property, separate property) before you start to fill out the forms.

What you need to know about property and divorceWhat you need to know about spousal support (alimony) in California

-

Confirm you can file in California

To file for divorce in California, either you or your spouse has to have lived in California for the past 6 months and in your current California county for at least 3 months.

This is known as meeting the residency requirement.

See the exceptions for same-sex couples.Answer: You may be able to file for a legal separation. You can then file for divorce once you meet the requirements. Learn about legal separation -

Figure out which county to file in

You can file for divorce in the county where either you or your spouse has lived for the past three months.

This may mean that you could file in more than one county.

Check to see where you can fileRead more content -

Fill out forms

Fill out Petition — Marriage/Domestic Partnership (form FL-100)This form asks for basic information about your marriage and the type of orders you want the court to be able to make about things like spousal support and property.

Fill out Summons (Family Law) (Form FL-110)This form tells your spouse that you've started a court case and that they have 30 days to respond.

-

Figure out if you need the court to decide something right away

Some courts have additional local forms they require you to use.

Contact your court clerk’s office, check your court’s website, or talk to your family law facilitator or self-help center to ask if they have any local forms you need to use.

-

Make copies of your forms

After you’ve filled out the forms and signed the Petition, make 2 copies of both forms.

Phase 1: Starting a Divorce

Here's a simplified version of the typical process for starting a divorce. There are many ways this process may be different depending on your situation. For example, it’s possible to get a divorce even if the other spouse doesn’t respond to the divorce papers.

Select a task from the diagram or from the list below to get step-by-step instructions and also to find out what to do if your situation doesn’t follow the typical path

Filing your divorce petition and summons

-

Take your forms to the court clerk

Check Find my Court to find the courthouse in your county that accepts divorce filings. Look for the courthouse location that lists “Family” as one of the subjects under “Matters Served.”

At the courthouse, you’ll file the forms by giving the original and the 2 copies to the clerk.

The clerk will give you a case number and stamp the forms

The court will keep the original and return the copies to you. One is for you, the other for your spouse.

-

Pay a filing fee

You’ll need to pay a fee of $435-$450 to the clerk when you file your forms.

If you can’t afford the fee, you can ask the clerk for a fee waiver. You qualify for a fee waiver if:

- You receive public benefits

- Your income falls below a level classified as low income

- You can’t afford the fee and to meet your basic needs

-

Wait to see if the claim of exemption is opposed

The debt collector has 10 days (15 if the sheriff serves them by mail) to oppose your claim. If not opposed, your claim is granted, and the amount of money claimed as exempt is returned.

Phase 2: Sharing Financial Information

Sharing financial information with your spouse is a requirement for getting divorced

To divorce, you must share complete and up-to-date information about your finances with your spouse and your spouse must share this with you. This is called disclosure. You can’t get divorced if you don’t share financial information.

Not only is sharing this information required, but being upfront makes it easier to work out an agreement with your spouse. You need this information to divide your property and debts equally and make decisions about child and spousal support.

You must share financial information by a deadline.

The first time you give your spouse this information it’s called preliminary disclosures You must complete preliminary disclosures by a deadline:

- 60-days after filing for divorce, if you’re the petitioner

- 60-days after you’re served with divorce papers, if you’re the responden

Sometimes, you also must make a second disclosure, a final disclosure, at the end of your case. This happens if you end up having a trial. If you don’t have a trial, you can waive this final requirement.

How to serve divorce papers using personal service

The primary way this is done is called personal service. This means another adult, not you, hands them a copy of the filed papers. This person is your server.

Your server must complete a form and file it with the court to prove they delivered the papers.

There are alternatives to personal service. There are a few situations when personal service is not allowed, not possible, or requires extra steps. For example, the person is out-of-state, in jail, or you can’t find them.

See guidelines for service in special situations

-

Choose a server

You can't serve papers yourself. Ask another adult – a server – to deliver the papers.

Your server must be

- 18 or over, and

- Not part of your case

Your server can be:

- Someone you know

- The county sheriff (in most, not all, counties)

- A professional process server you hire

The sheriff charges to serve papers unless you have a fee waiver.

-

Figure out when to serve

There’s no specific deadline to serve the divorce petition, but you can't move your case forward until you serve your spouse.

Once they are served, they have 30-days to respond. After that, you can move your case forward even if they don’t respond.

Read more content -

Fill out forms

Fill out Petition — Marriage/Domestic Partnership (form FL-100)This form asks for basic information about your marriage and the type of orders you want the court to be able to make about things like spousal support and property.

Fill out Summons (Family Law) (Form FL-110)This form tells your spouse that you've started a court case and that they have 30 days to respond.

-

Have your server give the papers to your spouse

Your server must find the person and hand them these forms:

- Copies of forms you filed with the court (except any fee waiver forms)

- Blank Response - Marriage/Domestic Partnership (form FL-120)

- Blank response forms if you filed other papers

Your server should note the address where they gave your spouse or partner the papers, along with the date and time. The server needs this information to fill out the Proof of Service form.

If the other person won’t take the papers, your server may leave them by the person and tell them what they are. For example, your server can leave them on the doorstep and say, 'These are important legal papers for you.' -

Have your server complete the Proof of Service form

You can use(form FL-115). Proof of Service of Summons

It helps if you fill in the top part of the form with the case and court information.

Your server can then fill in the information about how, when, and where they served the papers. Your server must sign the form.

-

Copy and file the Proof of Service form

- Make a copy of your Proof of Service form.

- File the original and copy with the court where you filed the papers. The court will stamp and return the copy.

- Keep the copy of the Proof of Service form for your records.

What’s next?

Once you’ve served the petition and summons forms, your spouse has 30 days to respond. How they respond will determine how you’ll move forward with your case.

Regardless of how they respond, you’ll need to complete your financial disclosures.

Phase 3: Reaching and documenting an agreement

- How you divide your property and debts

- Whether anyone will pay spousal support

You can work with your spouse to decide these issues together. If you can’t agree, you can ask the court to decide.

Phase 4: Finalizing a Divorce

To finish your divorce, you must turn in a set of final forms along with your agreement to the court.

The details of this process are slightly different depending on how you and your spouse are working together, or if you’re not.

There are alternatives to personal service. There are a few situations when personal service is not allowed, not possible, or requires extra steps. For example, the person is out-of-state, in jail, or you can’t find them.

See guidelines for service in special situations

Brow Description

Divorce Test

-

Complete Forms

Complete the appropriate forms to ask the court to change your name.

Civil Case Cover Sheet (form CM-010)Petition for Change of Name (form NC-100)Attachment to Petition for Change of Name (form NC-110) [2 Adults add “per person”]Order to Show Cause for Change of Name (form NC-120)Decree Changing Name (form NC-130) -

Make Copies & File

Make copies of your forms and file them with the court. The court will take a first appearance fee ($435), unless you file a fee waiver. -

Publish in a Newspaper

Publish one of the forms, the Order to Show Cause for Change of Name (form FL-120) in a newspaper in your county. -

Tentative Rulings and Obtain Decree

Check your court’s tentative rulings the court day before your hearing (if applicable), attend hearing if required, and obtain your decree.Read more content -

Tentative Rulings and Obtain Decree

Check your court’s tentative rulings the court day before your hearing (if applicable), attend hearing if required, and obtain your decree.Someone took money from my paycheck 2

Serve each person you are suing.

Next Steps

What can we help you with today?

Brow Description

What to know about property law if you’re getting a divorce

California divides property two categories: community property and separate property

Community property: This is what either of you earned (or debt you took out) after you married, but before you separated. The “community” is you and your spouse. The property belongs to you both equally.

Separate property: This is what you had before you married or got after you separated. Gifts or inheritance to one of you is also separate property. Separate property means it belongs to one of you.

Community and separate property applies to property and debts you owe.

In general, after a divorce, you keep your separate property and divide your community property.

Community or separate? It generally depends on your date of separation

You need to know when you married and when you separated to figure out what's separate property and what's community property. The day of your marriage is generally easy to figure out. Separation can be trickier. Figure out your date of separation:

-

Start with the day that you let your spouse know (by actions or words) that you wanted to end your marriage

-

Confirm that after that day, your actions were consistent with wanting to end your marriage

-

I didn't knowthere was a court case.

Depending on the reasons, you may be eligible to "set aside" the default judgement, or you might be able to negotiate a settlement with the debt collector.

For some people, this is the day they moved out. For others, this is a day the two spouses agreed together that their marriage was over, and they made plans to divorce. From that day forward, what you or your spouse earned or loans you took out were no longer community property.

For some people, this is the day they moved out. For others, this is a day the two spouses agreed together that their marriage was over, and they made plans to divorce. From that day forward, what you or your spouse earned or loans you took out were no longer community property

How to tell when something is separate property

Separate property is:

-

Anything you earned or owned (or a debt) from before you married or after you separated

-

Gifts or inheritance (to one of you) even if it was given or inherited when you were married

-

I didn't knowthere was a court case.

Depending on the reasons, you may be eligible to "set aside" the default judgement, or you might be able to negotiate a settlement with the debt collector.

Anything you buy with separate property or you earn from separate property is also separate property.

-

Example

Someone took money from my paycheck

-

Wage Garnishment

If you bought a car with money that only you earned while married, the car is community property even though the money used to pay for it was earned by one spouse and not the other.

If you have separate property, it belongs only to you, as long as it was kept separately. Kept it separately means you didn’t give it to your spouse. Debts can be separate property too, such as credit cards you might get after you separate.

After divorce, each of you can keep your separate property.The court does not divide separate property. Instead, the court “confirms” it is your separate property.

Anything you buy with separate property or you earn from separate property is also separate property.How to tell when something is community property

Community property is:

-

Anything you earned while married

-

Anything you bought with money you earned while married

-

Any debt you take on while married

-

EXAMPLE

If you bought a car with money that only you earned while married, the car is community property even though the money used to pay for it was earned by one spouse and not the other.

Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.Community property is:

You may have more community property than you realize.Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.

You may have more community property than you realize.Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.

How to tell when something is separate property

Community property is:

-

Anything you earned while married

-

Anything you bought with money you earned while married

-

Any debt you take on while married

Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.

You may have more community property than you realize. Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.

You may have more community property than you realize. Property you didn’t earn, like a gift or inheritance one of you received while married, is not community property.

Other Styles

Apparently we had reached a great height in the, word Error status for the sky was a dead black, and the stars had ceased to twinkle.

-

EXAMPLE

If you bought a car with money that only you earned while married, the car is community property even though the money used to pay for it was earned by one spouse and not the other.

-

EXAMPLE

If you bought a car with money that only you earned while married, the car is community property even though the money used to pay for it was earned by one spouse and not the other.

-

EXAMPLE

If you bought a car with money that only you earned while married, the car is community property even though the money used to pay for it was earned by one spouse and not the other.

Next Steps

What can we help you with today?

Brow Description

After a Judgment in a Debt Collection Case

- You will not go to jail for having a judgment against you.

- If you receive a wage garnishment or bank levy, you have only days to take action.

- There are ways you can control the repayment of the judgment.

Next Steps

What can we help you with today?

Brow Description

Bank Levy

What did the bank notice say?

Filing a claim of exemption for bank levy

The amount taken will be up to the amount of the judgment plus interest. The levy is not continuous; it only takes the money in the account at the time of the levy. Funds deposited after the levy are not taken. You may be able to get some or all of the money levied depending on the source of the funds deposited into the account or your financial situation.

If your bank account is levied, you must act quickly! You have only ten days from the date of the levy to file a claim of exemption (plus five days if the notice was sent by mail) with the sheriff performing the levy.

Relevant Files

- This item is mapped from list block (Enforcement of Judgement) (Form EJ-160)

- Financial Statement (Form EJ-165)

Steps to pay in installments

-

Prepare the claim of exemption

Prepare a Claim of Exemption (form WG-006) and Financial Statement (form WG-007)

Read more content -

File the claim of exemption

File the original plus one copy with the sheriff shown on the Notice of Levy (form EJ-150) form within 10 days (15 days if the Notice of Levy was served by mail)

Read more content -

Wait to see if the claim of exemption is opposed

File the original plus one copy with the sheriff shown on the Order to Withhold Wages within 10 days (15 if the Order to Withhold Wages was served by mail).

Read more content -

Reply to the opposition, if any

Serve and file your reply, if any with the court

Read more content -

Attend the hearing, if any

Gather your evidence. Check tentative rulings the court day before if your court uses them.

Read more content

Direct-deposit federal benefit accounts

You likely received this notice because your bank account is a Social Security direct-deposit account.

Federal benefits are exempt from a bank levy, and in recent years federal regulations have required banks to look at whether an account is receiving federal benefits before levying any funds. If an account is a deposit account for federal benefits the bank then looks at the total amount of benefits deposited in the two months prior to the levy. If the balance in the account is less than the two months of benefits, the bank does not levy the account, and sends a notice of this to the account holder. If the account balance exceeded the levy amounts, then only the amount over these two months of benefits would be taken.

As long as your account balance is less than two months of the federal benefits being deposited into it, your account will remain safe from garnishment.

Relevant Files

- This item is mapped from list block (Enforcement of Judgement) (Form EJ-160)

- Financial Statement (Form EJ-165)

Next Steps

What can we help you with today?

Brow Description

General information about judgments, collection, and your options

- You would owe the full amount right away unless the judge ordered a payment plan (or you are filing an appeal).

- The court does not take any steps to collect a judgment on its own. It is up to you to pay the judgment, or the debt collector to collect the judgment.

- As long as the judgment is unpaid, it will gather interest at 10% per year. The sooner a judgment is paid, the less interest you will have to pay on top of the judgment.

Why did I receive a judgment?

You received a judgment because the court decided against you in a court case. This could have happened in one of a few ways:

By default

Because you didn't respond to the lawsuit.

At the beginning of a case, the defendant is supposed to serve you with a few documents including a Summons and Complaint. This means that someone is supposed to hand you or someone in your home or work with a copy of these documents. If they hand it to someone else, a copy is supposed to be mailed to you. This starts your time to respond to the lawsuit. Normally, you have 30 days to respond. If you do not, the other side may request "default" and ask the court to decide the case without you.

-

I didn't understand I needed to file a response.

If you act quickly, you may be eligible to "set aside" the default judgment, or you might be able to negotiate a settlement with the debt collector.

-

I didn't know there was a court case.

Depending on the reasons, you may be eligible to "set aside" the default judgment, or you might be able to negotiate a settlement with the debt collector.

After trial

After each side appears in court to present their case.

After a motion for summary judgment or judgment on the pleadings

After the debt collector files a motion to decide the case without trial.

What can happen next

In collection cases, it is common for a debt collector to try to collect by:

-

Wage garnishment

Taking up to 25% of after-tax wages

-

Lien against real property

Making it so you cannot sell, re-finance, or buy land without paying

-

Bank levy

Taking the money from a bank account or emptying a safe-deposit box

You have the opportunity to defend against each type of collection. You may also negotiate a settlement with the debt collector, or in a limited civil case (under $25,000) file a motion to pay judgment in installments.

How can I protect my money or things from collection?

When a debt collector tries to collect, you may attempt to defend your money or property from collection. Other than negotiating a settlement, these defenses do not reduce a judgment, or stop interest from being added to the judgment.

-

Wage garnishment

Claim of exemption (Wage Garnishment)

-

Lien against real property

Pay the judgment, negotiate a settlement

-

Bank levy

Claim of exemption (Bank Levy)

Next Steps

What can we help you with today?

Brow Description

Liens against real property

This lien will prevent you from buying, selling, or refinancing any land until the lien is cleared. Liens are on a county-by-county basis, so having a lien in one county does not affect your property in another.

To clear the lien, you must either pay the judgment in full or negotiate a settlement with the debt collector.

Next Steps

What can we help you with today?

Brow Description

Negotiating a Settlement

Common types of settlements include:

- A lump sum payment of less than the full amount to settle the entire judgment

- A partial lump sum payment, plus monthly payments until a set amount is paid

- Monthly payments with or without any discount to the judgment or even

- Dismissal of the case/judgment

Benefits of settlement

Settlements allow you to take control of the judgment and set its terms. Settlements are often successful because each party has agreed to it, and is therefore more willing to do what is agreed.

Ideally, a settlement should allow you to leave in a better position than if you did nothing. For you, that may be paying less, or paying on more favorable terms. To the debt collector, this could be collecting sooner rather than later, and with less effort.

Steps of Negotiation

Next Steps

What can we help you with today?

Brow Description

Motion to pay judgment in installments

-

Prepare the Motion to Pay Judgment in Installments

Follow the instructions or use the guided interview to pay the judgment in installments -

File the Motion to Pay Judgment in Installments with the court

File the original plus three copies of the Motion to Pay Judgment in Installments with the court, following local procedure -

Wait for opposition

If opposed, the opposing party will serve an opposition at least 9 court days before the hearing -

Reply to opposition, if any

If opposed, reply to the opposition up to 5 court days before the hearing -

Attend the hearing

Gather your evidence. Check tentative rulings the court day before if your court uses them.

Next Steps

What can we help you with today?

Brow Description

Filing a claim of exemption for wage garnishment

- You will not go to jail for having a judgment against you.

- If you receive a wage garnishment or bank levy, you have only days to take action.

- There are ways you can control the repayment of the judgment.

If your wages are garnished, the debt collector can take up to 25% of your after-tax wages. If your income is low or near minimum wage, the amount taken may be less than 25%. Unfortunately, some employers miscalculate the amount below 25%.

By law, your employer cannot fire you or take other action against you for a single wage garnishment.

If you are unable to afford the amount to be garnished from wages, a claim of exemption may reduce or stop the withholding. Act quickly! If you file within ten days you might be able to prevent the garnishment from starting. Even if the garnishment starts, file as early as possible, since the sheriff will hold onto funds levied after filing the claim of exemption. Once the garnishment starts and funds are transferred to the debt collector, it is almost impossible to get them back.

Relevant Files

- This item is mapped from list block (Enforcement of Judgement) (Form EJ-160)

- Financial Statement (Form EJ-165)

-

Prepare the claim of exemption

Prepare a Claim of Exemption (form WG-006) and Financial Statement (form WG-007) -

File the claim of exemption

File the original plus one copy with the sheriff shown on the Order to Withhold Wages within 10 days (15 if the Order to Withhold Wages was served by mail) -

Wait to see if the claim of exemption is opposed

File the original plus one copy with the sheriff shown on the Order to Withhold Wages within 10 days (15 if the Order to Withhold Wages was served by mail). -

Reply to the opposition, if any

Serve and file your reply, if any with the court -

Attend the hearing, if any

Gather your evidence. Check tentative rulings the court day before if your court uses them.

In addition to your claim of exemption, you may be able to negotiate a settlement of your judgment. If the judgment was entered because you did not file an Answer in the case, you may be able to file a motion to set aside the judgment if you did not know about the case, the documents starting the case were never served, or you didn’t file an Answer due to inadvertence, mistake, or excusable neglect.

Next Steps

What can we help you with today?

Name Change

Whose name is being changed?

Details:

-

Prepare the claim of exemption

Complete Claim of Exemption Forms

Claim of Exemption (form WG-006) and a

Financial Statement (form WG-007).

Use a guided interview to complete these forms online or use follow these instructions.

Submit the Claim of Exemption Forms

Make 2 copies of your completed forms.

Keep one copy for yourself.

Take or mail the originals and one copy to the Levying Officer identified in the upper right-hand corner of the Earnings Withholding Order (form WG-002). This is usually the sheriff. It may or may not be your local sheriff.

The sheriff keeps the original and sends a copy to the debt collector.

If your bank account is levied, you must act quickly! You have only ten days from the date of the levy to file a claim of exempltion (plus five days if the notice was sent be mail) with the sheriff performing the levy.

-

File the claim of exemption with the sheriff

File the original plus one copy with the sheriff shown on the Notice of Levy (form EJ-150) form within 10 days (15 days if the Notice of Levy was served by mailRead more content -

Wait to see if the claim of exemption is opposed

The debt collector has 10 days (15 if the sheriff serves them by mail) to oppose your claim. If not opposed, your claim is granted, and the amount of money claimed as exempt is returned.

Brow Description

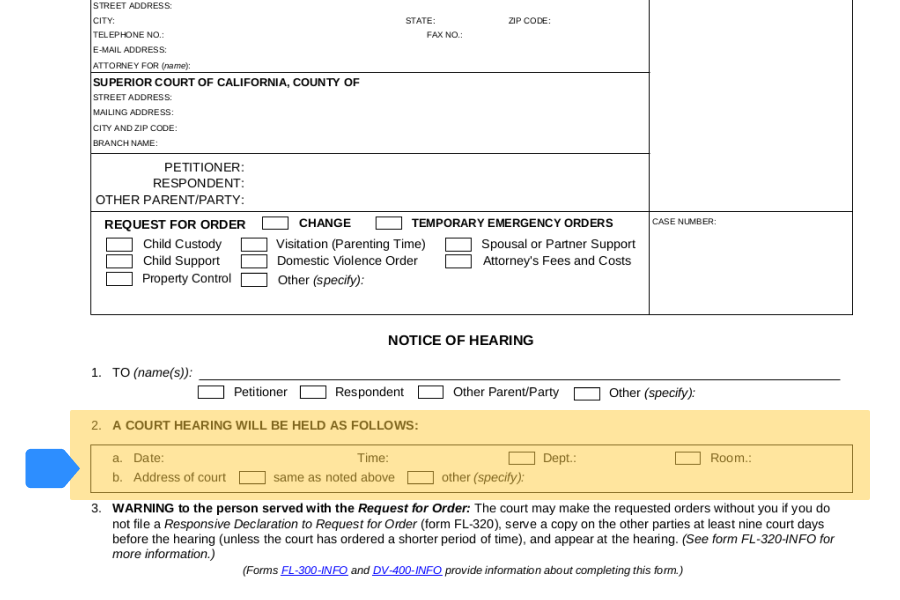

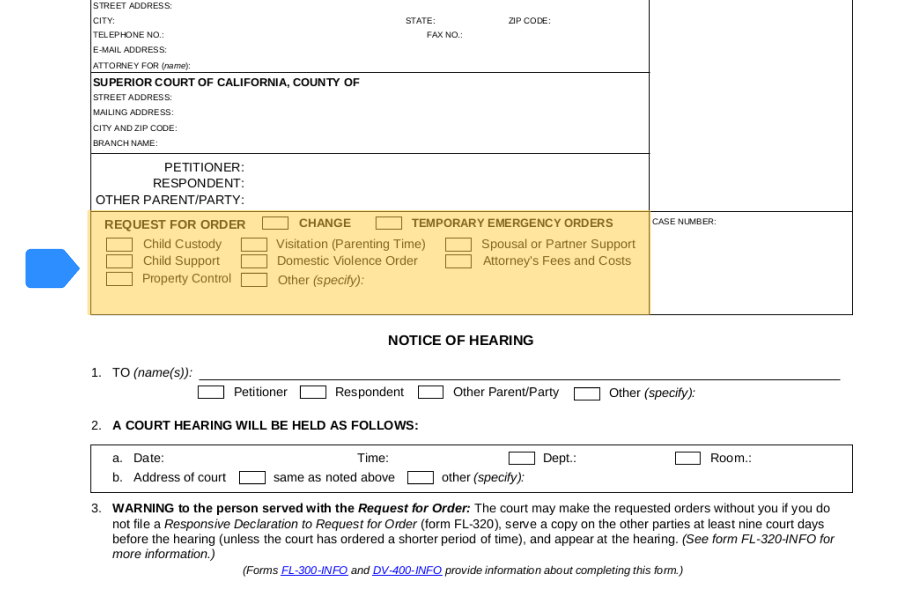

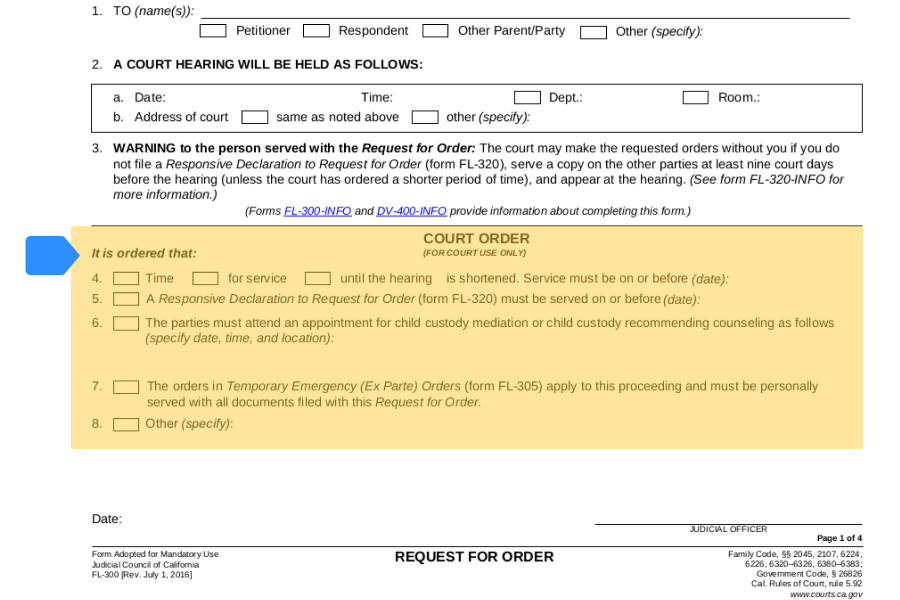

Form FL-300

The other party in your family law case is asking the court to make a decision. The court set a date to hear from both sides (a "hearing") before it makes a decision.

Page 2

Page 2

Hearing Date and Time

The date, time, and place is on the first page.

Page 2

Page 2

What the Other Party is Asking the Court to Decide

The topic of the request is checked on the first page. Exactly what the person wants the Court to decide and why are on Pages 2-4 and any attachments.

If "Change" is checked it means that there's already an order about this issue and the other party wants that changed.

If "Temporary emergency orders" is checked it means the other party asked the court to decide something urgent before the hearing. If the Court agreed, item 7 at the bottom of Page 1 will be checked and the orders will be attached. These orders are temporary. They only last until the hearing. You must follow these orders.

Orders Made Before the Hearing

Sometimes the Court makes orders about what one or both sides must do before the hearing. For example, if the hearing is about child custody and visitation, the Court may order you to attend mediation. You must follow any orders listed.

What you can do

No matter what you decide to do, right now you need to:

- follow any orders in or attached to the Request for Order

- go to mediation, if ordered in item 6 on Page 1

You have options to respond. If you don't respond, the Court will decide without your input.

There's generally no cost to respond. If this is the first time you are filing papers in the case, there may be a fee. If you can't afford the fee, you can ask for a fee waiver.

Unless there is a restraining order, contact the other side to see if you can agree. If you do, you can submit a signed written agreement to the Court and request to cancel the hearing.

At the hearing, the Court will only make decisions about the issues listed in the Request for Order (FL-300). If you want the Court to decide about something else, you must file your own Request for Order (Fl-300).

Additional Fields

Check your document to see if the following fields were selected and if so find out about each of those sections.

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.

- This is a list item

- Another list item

No Soldier shall, in time of peace be quartered in any house, without the consent of the Owner, nor in time of war, but in a manner to be prescribed by law.

The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.

No person shall be held to answer for a capital, or otherwise infamous crime, unless on a presentment or indictment of a Grand Jury, except in cases arising in the land or naval forces, or in the Militia, when in actual service in time of War or public danger; nor shall any person be subject for the same offence to be twice put in jeopardy of life or limb; nor shall be compelled in any criminal case to be a witness against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.

Serving your papers

What type of service are you interested in?

More Steps

How can we help you today?

Morbi at auctor turpis. Morbi pellentesque dui quis congue rutrum. Nam quis rhoncus felis, vel egestas risus. Maecenas quis semper sem. Pellentesque consectetur ultrices varius. Aliquam placerat erat vitae leo rutrum, pharetra interdum sapien iaculis. Donec mattis nibh neque, et placerat dolor pretium in. Nullam vehicula risus ac mi pharetra elementum. Proin blandit, justo sed rutrum gravida, ex leo ullamcorper risus, sit amet tempor justo sem id tellus. Vestibulum lobortis sem sed tellus cursus consectetur. Proin in dictum diam. Vivamus vel velit tincidunt lacus vulputate blandit. Nulla mollis erat nec justo condimentum, at tempus arcu rhoncus.

Morbi at auctor turpis. Morbi pellentesque dui quis congue rutrum. Nam quis rhoncus felis, vel egestas risus. Maecenas quis semper sem. Pellentesque consectetur ultrices varius. Aliquam placerat erat vitae leo rutrum, pharetra interdum sapien iaculis. Donec mattis nibh neque, et placerat dolor pretium in. Nullam vehicula risus ac mi pharetra elementum. Proin blandit, justo sed rutrum gravida, ex leo ullamcorper risus, sit amet tempor justo sem id tellus. Vestibulum lobortis sem sed tellus cursus consectetur. Proin in dictum diam. Vivamus vel velit tincidunt lacus vulputate blandit. Nulla mollis erat nec justo condimentum, at tempus arcu rhoncus.

What can we assist you with?

Morbi at auctor turpis. Morbi pellentesque dui quis congue rutrum. Nam quis rhoncus felis, vel egestas risus. Maecenas quis semper sem. Pellentesque consectetur ultrices varius. Aliquam placerat erat vitae leo rutrum, pharetra interdum sapien iaculis. Donec mattis nibh neque, et placerat dolor pretium in. Nullam vehicula risus ac mi pharetra elementum. Proin blandit, justo sed rutrum gravida, ex leo ullamcorper risus, sit amet tempor justo sem id tellus. Vestibulum lobortis sem sed tellus cursus consectetur. Proin in dictum diam. Vivamus vel velit tincidunt lacus vulputate blandit. Nulla mollis erat nec justo condimentum, at tempus arcu rhoncus.

Morbi at auctor turpis. Morbi pellentesque dui quis congue rutrum. Nam quis rhoncus felis, vel egestas risus. Maecenas quis semper sem. Pellentesque consectetur ultrices varius. Aliquam placerat erat vitae leo rutrum, pharetra interdum sapien iaculis. Donec mattis nibh neque, et placerat dolor pretium in. Nullam vehicula risus ac mi pharetra elementum. Proin blandit, justo sed rutrum gravida, ex leo ullamcorper risus, sit amet tempor justo sem id tellus. Vestibulum lobortis sem sed tellus cursus consectetur. Proin in dictum diam. Vivamus vel velit tincidunt lacus vulputate blandit. Nulla mollis erat nec justo condimentum, at tempus arcu rhoncus.